RetailTech: How ParallelDots is modernizing retail execution

ParallelDots helps FMCG companies & retailers optimize their in-store execution & maximize their sales using image recognition.

Remember when you walked into your nearby retail store and couldn’t find your favorite flavor of Lays?

Did you know high margin items in a retail store are intentionally placed at eye-level to nudge you to buy them? [Eye level is the buy level]

This in-store execution is what a lot of FMCG companies are striving to nail down. With the FMCG industry growing at only 3-4% globally and e-commerce share [in total retail sales] still around 14-15%, FMCG companies have become more focused on what is happening with their brands' share versus the competition in retail stores.

Before we dive deep into the story, here are some key terms that will make it easier for you to understand the article.

Key Terms

Out of Stock [OOS]: Out of Stock or Stockout is the term used to describe the phenomenon of when inventory for a particular product is exhausted.

Share of Shelf [SOS]: Share of shelf is a metric that compares the facings of a given brand to the total facings positions available.

Planogram: A planogram is a diagram that shows how and where specific retail products should be placed on retail shelves or displays in order to increase customer purchases.

Annotated Data: Data annotation is the process of labeling the data available in various formats like text, video, or images. Labeled data sets are required so that machines can easily and clearly understand the input patterns.

B2B SaaS [Business to Business Software as a Service]: B2B SaaS refers to companies that sell software to other businesses as a service. These products help organizations run more efficiently or automate internal functions. Many businesses rely on these services to optimize their marketing, sales, and customer service efforts.

Ramen profitable: Ramen profitable means a startup makes just enough to pay the founders' living expenses.

Retail Execution: Before vs. Now

In the conventional setup, Field Sales Representatives [FSRs] need to manually observe, count or guess in-store conditions and fill cumbersome forms on their handheld devices. KPIs include share of shelf [SOS], more premium eye-level positions, presence of their brands within the store, out of stock [OOS] situations, planogram compliance, competitors displacing shelf gaps, price mismatch, and getting the maximum mileage with the placement of point of sale material [POSM].

Doing all these tasks manually is time-consuming & prone to error and often leads to loss of sales.

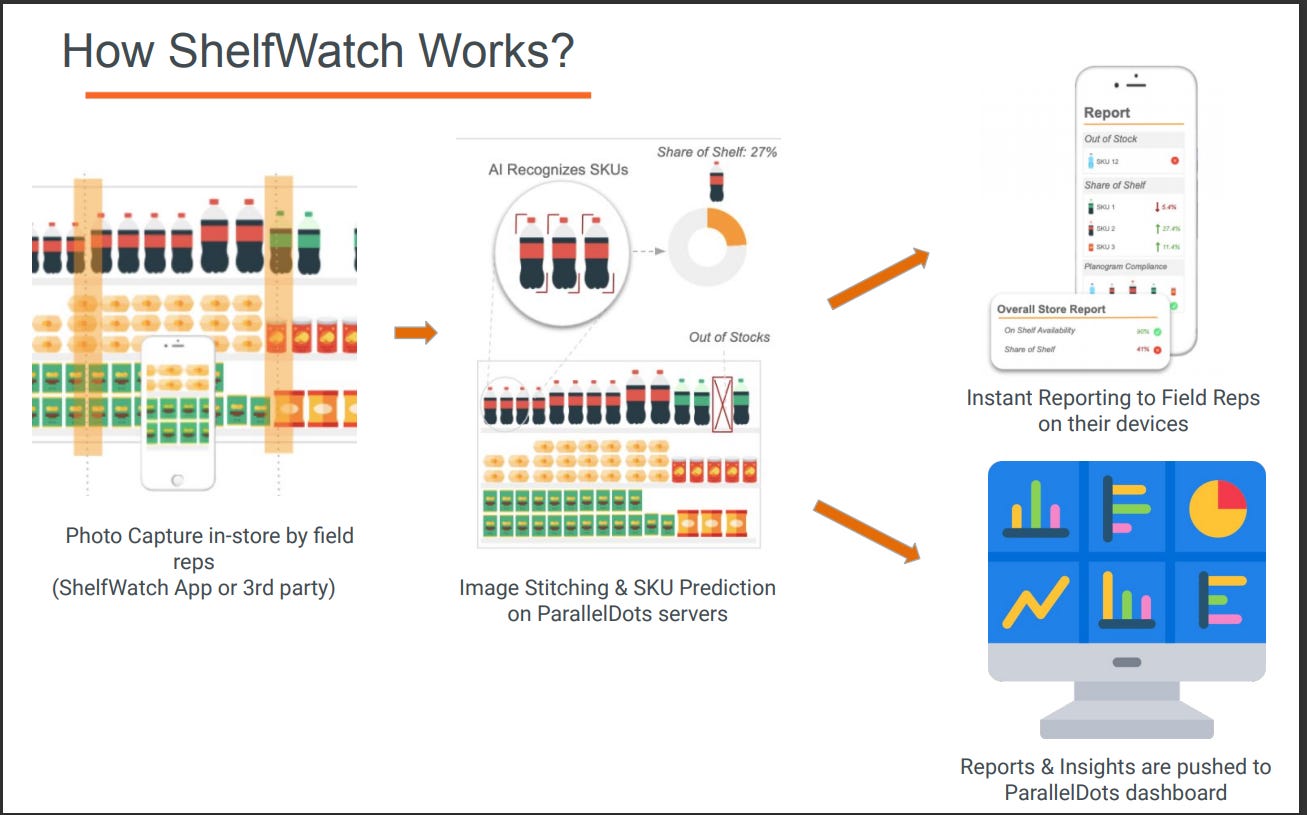

This is where ParallelDots comes in. ParallelDots’s flagship product, ShelfWatch, enables FSRs to click a photo of the shelf, upload it on the cloud and get actionable real-time insights to improve their retail sell-through.

We sat down with Muktabh Mayank [Co-founder of ParallelDots] to learn more about his 7-year topsy-turvy entrepreneurial journey to build different AI products across industries -> news, healthcare & finally, retail.

How did you come up with the idea?

Muktabh is a BITS Pilani alum [2008–12]. He interned at Opera Solutions in 2012, where he was exposed to Machine Learning & AI. Keep in mind that this was in 2012 when AI/ML hadn’t become so hot as they are now. Andrew Ng also launched his now-famous Machine learning course around the same time. Muktabh did a course on Data Mining, too, once he returned to campus.

He joined Opera Solutions full time after graduating and met Angam [CEO of ParallelDots, then a Business Analyst at Opera]. Along with Ankit [Co-Founder of ParallelDots, Angam’s batchmate from IIT-KGP], they launched an AI-based news timeline product, but that didn’t work out due to an unclear monetization plan.

Armed with in-depth domain knowledge of deep learning, they started taking up projects from market research firms, analyzing customer interview data & generating insights from them [sentiment analysis, keyword extraction, etc. using text APIs]. These market research firms used to work with FMCG firms. Muktabh & co. found out that these FMCGs had a lot of retail store images with them but did not know how to utilize them efficiently.

Through this bouncing between different ideas, they started analyzing retail photographs and presented them to one of India's largest FMCG companies, who became their first client. They realized that such FMCGs were sitting on massive datasets waiting to be explored, and no one was helping them do that at scale. But a successful pilot gave a strong enough validation to their idea.

How exactly does ParallelDots help FMCG clients?

ParallelDots has helped FMCG clients unlock 25+ KPIs, which were impossible to track manually. With a 10–15% increase in OSA [On-Shelf Availability], up to 60% increase in display compliance & a 30% increase in planogram compliance, ParallelDots makes sales operations more agile and efficient for FMCGs.

Challenges

Challenge #1: Annotating Data

The biggest challenge when building an AI-based product is in the intermediate phase, where you’re annotating data. Think of a popular AI-based product, say, Facebook. The only way Facebook can continue to grow is through collecting & analyzing terabytes of data to improve its data model. The more the data, the more the learning, and the higher is the accuracy. To organize this data, annotate it & make it strong enough to generate useful insights requires a significant upfront investment [if not significantly better than what the client’s in-house team can build]. A half-baked product won’t generate revenue.

Luckily, ParallelDots raised investment in 2017 and could invest this money in annotating data. They were quickly able to develop an evolved data model required to solve a use case.

#learningwithSU: If you are starting an AI company, you need to have some initial capital to experiment. An off the shelf product won’t work for enterprise clients.

Challenge #2: Build a refined product

It brings us to another challenge in the B2B SaaS market. While in B2C, investors judge by traction, in B2B, they judge by revenue. And when the client is signing a cheque, he holds a particular responsibility within the organization and is answerable to scrutiny on the expense made. You need to build a refined product that promises significant ROI right from day 1.

But first & foremost, before you even invest in building a product, the problem needs to be validated. The segment where the enterprise already has a clear problem is the easiest to get into. Demand creation tactics might work in B2C but not in B2B space since revenue is the key.

#learningwithSU: You may get away with a scrappy product in B2C, but B2B segment leaves little margin for error.

Challenge #3: Timing

Another challenge while starting up is timing the market right. This TED Talk by Bill Gross drives this point home very succinctly. [The single biggest reason why start-ups succeed | Bill Gross]. Muktabh talked about the different AI products they tried to create but didn’t work out.

Timing is everything. We tried an AI-based news timeline app, but that didn’t work out since we were a late entrant to the space. Then we used AI to detect blood clots in cranial CT scans & cavities in dental X-rays and sell that product in the US. But here we were a bit too early. In 2014, there was not a lot of funding for these ideas. Plus, getting FDA approval had a waiting time of 18–24 months. A year later, after we’d given up on the idea, the license categorization changed, and the waiting time dropped to 6 months. Only then, people started raising funds, and health-tech AI boomed.

Another challenge that B2B SaaS companies usually face is dynamic product requirements that vary from client to client. But fortunately for ParallelDots, the retail market is pretty standardized in terms of vital trackable metrics. Hence, tweaking the product for each client was not required.

Moat

ParallelDots, over the years, has undertaken many small side-projects in image & video processing leading to 4TB+ annotated data. Training their algorithms on such massive datasets gives them an incremental gain of 15–20% accuracy, a gap hard to fill by any incumbent startup. Even their biggest competitors do not possess such a high amount of annotated data.

ParallelDots’ flagship product, ShelfWatch, only needs one representative image to detect an SKU, promotional display, or POS materials, thus drastically reducing onboarding times, making it ideal for tracking new launches or measuring in-store display execution during peak holiday seasons. [One Shot Image Learning Technique]

You can read more about their technology here.

Awards & Recognition

In April 2020, ParallelDots won the Tech4Future Grand Challenge powered by the Japanese conglomerate SoftBank and Invest India. The Tech4Future challenge was launched to identify the most promising Indian startups in the domain of artificial intelligence (AI) and machine learning.

In November 2020, ParallelDots emerged as the winner of NASSCOM’s Emerge 50 2020 Awards in the RetailTech category.

Competition & Market Size

Most B2B SaaS startups target global markets. In this space, Singapore-headquartered Trax Retail [valued at $1.5 billion] is the largest firm. Other competitors include Clobotics in China, Vispera in Turkey but the unicorn-startup Trax is much ahead of everyone else.

According to a new market research report published by MarketsandMarkets, the global Image Recognition in Retail Market size is expected to grow from USD 1.4 billion in 2020 to USD 3.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 22.0% during the forecast period. The need to increase on-shelf availability, enhance customer experience, and maximize RoI is one of the major factors driving the market’s growth.

How many clients can you possibly have?

The world’s top 200 CPGs are all over the $500 million market capitalization mark. Many of these are in roughly 200 countries, which gives nearly 10,000 sales targets. For example, every Unilever is a separate sale. Every P&G will be a separate sale.

It’s a long tail, but the head is also decentralized and a mostly under-penetrated market. ParallelDots has set up a partnership program to maximize its sales outreach since it wants to expand the company in new geographies.

Revenue Model & Current Metrics

Most standard contracts are yearly, with a big-ticket starting from tens of thousands of dollars annually, with costing depending on the number of photos & metrics required. Almost all deals have the potential to grow into $100k+ annual contracts. The firm has managed to sign 10+ CPG clients so far and turned ramen profitable in December 2020. [Muktabh fondly remembers the days when the core team used to work for 5000 Rs salary per month back in 2013–14].

However, Muktabh is quick to highlight how they are prioritizing growth at this stage of the Company. The team is currently gunning for expansion using the funding it raised in 2017 from Multipoint Capital. It raised 2 million USD that it wants to use to expand its sales team and invest in a robust tech team to handle additional scale.

How do you sell an AI SaaS product?

The average sales cycle at Paralleldots used to take 9–12 months initially. Thanks to early adopters who’ve helped shape the sales pitch regarding important metrics, this cycle is down to 6 months now. Though still high, the sales cycle is also justified at a 100k USD/year ticket size. With more templatization & a checklist-based speedy approach, it may even fall further.

In terms of the lead pool of FMCG companies, there’s a fascinating insight that comes up. FMCG companies follow a very decentralized structure. If P&G has its HQ in Ohio, then the Mumbai office will also have significant decision-making power. Therefore, you need to negotiate on pricing, key features, and SLA from scratch for every companies’ HQ separately. There is no central sale in retail.

Muktabh talks about the elephant-mice analogy in SaaS & quoted a famous blog while explaining sales at ParallelDots. An elephant client, i.e., an ARPA [Average Revenue per Account] of $100k+ will justify a long sales cycle. A mice client won’t.

Most of the biggest SaaS companies derive most of their revenues from selling expensive subscriptions to large enterprises. Workday, Veeva, Salesforce, you name it. If you have a good solution for a significant problem experienced by large enterprises, building a $100 million business is relatively straightforward. After all, you only need 1,000 customers, and the $100k you need from each of them is less than they spend on the salary of one executive.

Team

#learningwithSU: Founding a team is a lot like marriage. Some people just stick, not for the idea, not for the ambition but for the people.

Ankit, Angam & Muktabh [the three co-founders] have worked together for almost seven years now. Apart from working towards developing the product, the team has also published numerous well-cited research articles. Muktabh calls it a Ph.D. along with working in a startup. Muktabh himself has published twenty research papers & is cited over 200 times. He is quite active on Quora with 3.3 million content views.

For the business team, they hired experienced salespeople initially [for text APIs business] and expected them to set the business straight, but that did not work out.

#learningwithSU: Initially, founders will have to sell. Even tech cofounders need to sell. If you’re banking on experienced business folks to sell early on, it will turn into a service company very quickly.

New Avenues

Large players have now started exploring the retail segment [i.e., approaching retail stores to adopt image recognition technology solutions], which is much larger and more unorganized than the FMCG side. The problem is even direr in retail, since out of stock is a case of lost revenue. However, this is a different ball game altogether and is very under-penetrated. Bossa Nova is one of the few companies with some presence in this space.

ParallelDots has also started piloting its solution with two retailers recently [Earlier, it had FMCG clients only]. Among other offerings, it is also testing out a product to enable self-checkout from retail stores through smartphones.

The Road Ahead

Now that ParallelDots has found a certain amount of product-market fit, the focus is now firmly on sales. It is investing more & more resources into improving quality check processes, scaling up its sales team & robust technology. The company emphasizes publishing research papers to improve the product offering.

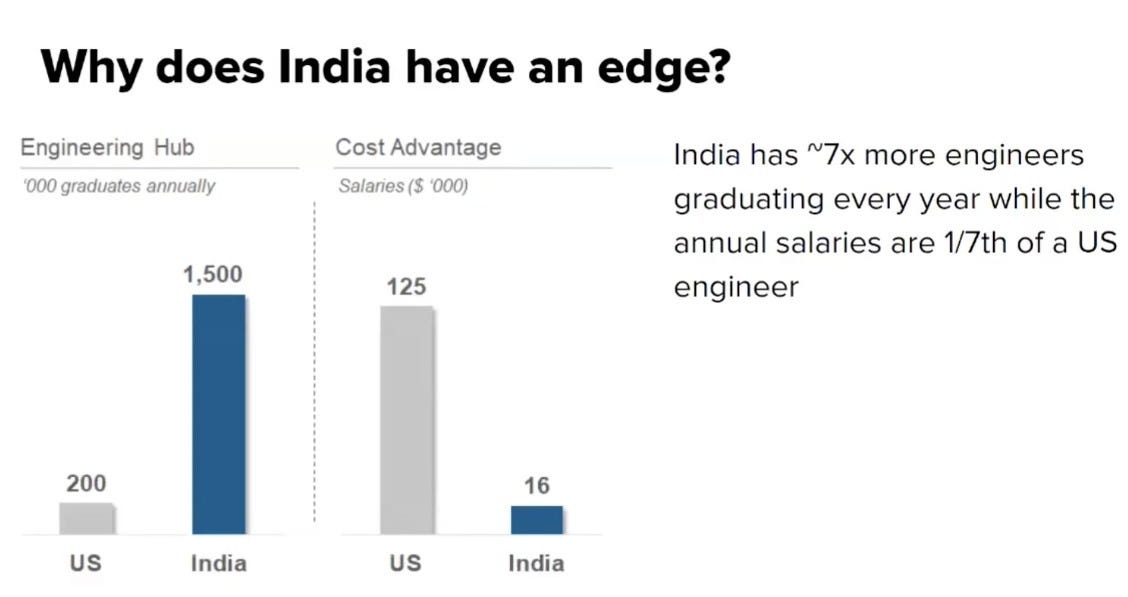

With India as a base and building for the world, ParallelDots is well-placed to optimize high-quality talent economically.

To leverage India’s cost advantages, ParallelDots needs to focus on capital efficiency. Focussing on a strong R&D unit and building a strong inside sales engine will be the key drivers of success.

Being an Indian startup and keeping a lower price also has a disadvantage. Clients assume if it is cheap, it won’t be a quality product. Positioning yourself as a better product, not a cheap alternative, is tricky.

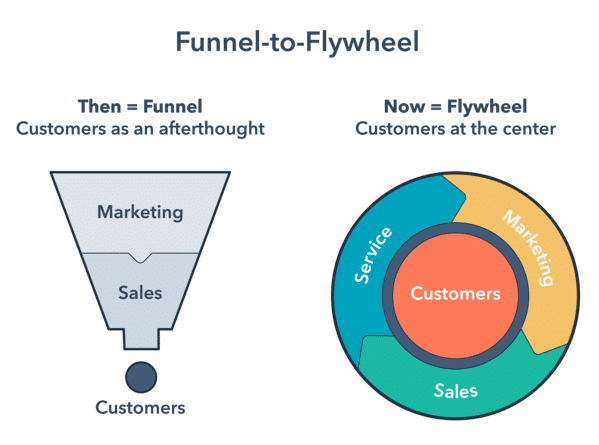

Since most of its revenue comes from global clients, navigating the cross border challenges would also be crucial. Managing cross-border teams, getting the sales flywheel going & focussing on post-sales implementation & customer support — makes or breaks a customer-centric AI startup.

If you loved reading this article, you can subscribe to the newsletter or follow us on Medium. [Yes, we are on Medium too!]