D2C: How Flatheads makes ridiculously comfortable shoes

As light as a glass of water, Flatheads' sneakers, manufactured from knit fibers & bamboo, are optimized for over 14 hours of comfort.

The internet ecosystem and evolving consumer needs have made new business models viable and have led to the emergence of the direct-to-consumer (D2C) distribution channel. Companies leveraging the D2C channel invariably have an emotional connect with their consumers, fostered by unique brand identity and a clear value proposition.

Today, India is witnessing the rise of D2C brands across categories and is estimated to become a USD 100 Bn addressable market by 2025. Rising digital buyer penetration among internet users, reaching 70.7% in FY20, creates a suitable opportunity for brands to go the D2C way.

D2C brands in the food & beverage space [Licious, Country Delight], beauty & personal care [Wow Skin Science, Mamaearth, MyGlamm, Sugar] & fashion [Lenskart, Clovia, Zivame, Bewakoof] are occupying niches and creating aspirational brands and extraordinary value in their respective sectors.

But, Footwear is one space where we haven’t seen a differentiated product for long.

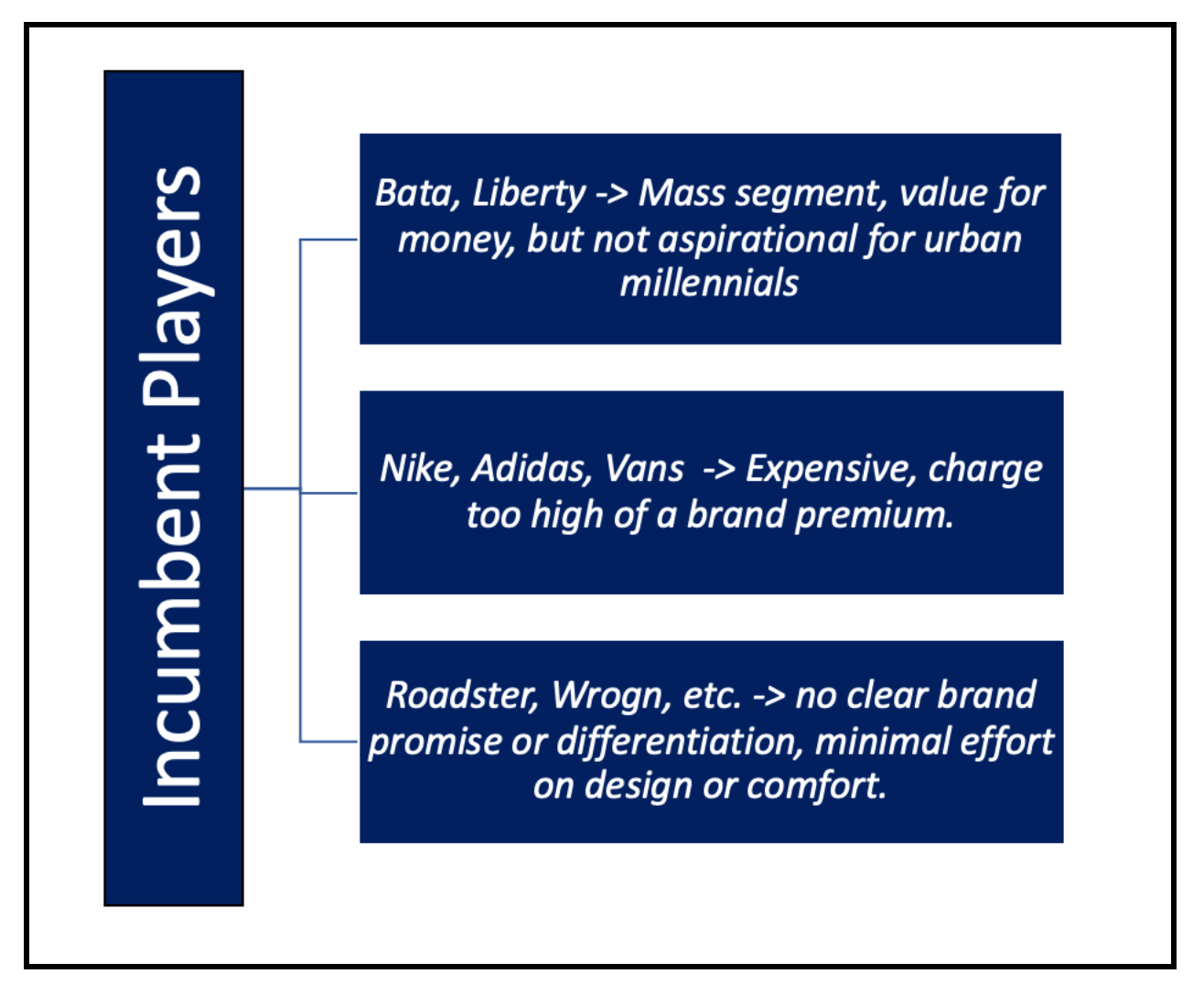

Affordable mass brands are not aspirational, while aspirational premium brands are not affordable.

Ganesh Balakrishnan, Co-founder of Flatheads, believes young urban Indian consumers are looking for stylish and comfortable footwear that they can wear all day long in both “work” and “fun” environments & Flatheads helps them complete the well-groomed look and provide optimum all-day comfort.

We sat down with Ganesh to learn more about Flatheads, how these shoes are different, and his learnings from the journey.

What was the insight?

Ganesh & his co-founder Utkarsh left their jobs in 2018 and started brainstorming on ideas in the D2C space. They figured out that now, there is an opportunity to build vertical brands since the horizontal marketplaces [Amazon, Flipkart] and vertical marketplaces [Myntra, Nykaa] stories have already scaled. In addition, e-commerce logistics is now plug-and-play and economically viable. Now, partnering with 3PL logistics providers like Delhivery/Bluedart, etc., is very easy, and they serve almost all pin-codes in India. That was the first hint that maybe, now is an excellent time to start a brand.

Incidentally, Utkarsh is a shoe freak — he owns roughly 120-130 pairs of shoes. Ganesh and Utkarsh had been trendspotting and brainstorming on ideas in footwear for a long time. They started observing and speaking to customers to understand the key nuances of footwear. They found that people have moved from formal wear to business casuals to casuals. However, it’s either sports/funky shoes or slip-ons/leather shoes or slippers & sandals when it comes to shoes. Like slip-ons/leather, most of these shoes look good but are not comfortable enough for everyday wear.

Utkarsh and I started Flatheads because we genuinely believe that we Indians deserve better all-day shoes than what we are getting.

Sports shoe brands talk about bounce in their shoes. They don’t tell you they are meant for running, not everyday wear. Online sites sell you shoes for Rs. 1000 that look great. They don’t tell you they feel like lead on your feet. Memory foam is great for pillows, but collapses under your body weight in shoes.

Indians like you & me need all-day shoes that are built for the tropical climate. Shoes that allow our feet to breathe. Shoes that are light, easy enough to wear for 14 hours. Shoes that cushion our feet, so they don’t tire out.

So the ideal shoe for everyday wear would be breathable, cushiony, and lightweight - perfect for the Indian tropical climate. And no brand offers such a product at a reasonable price.

Market Size

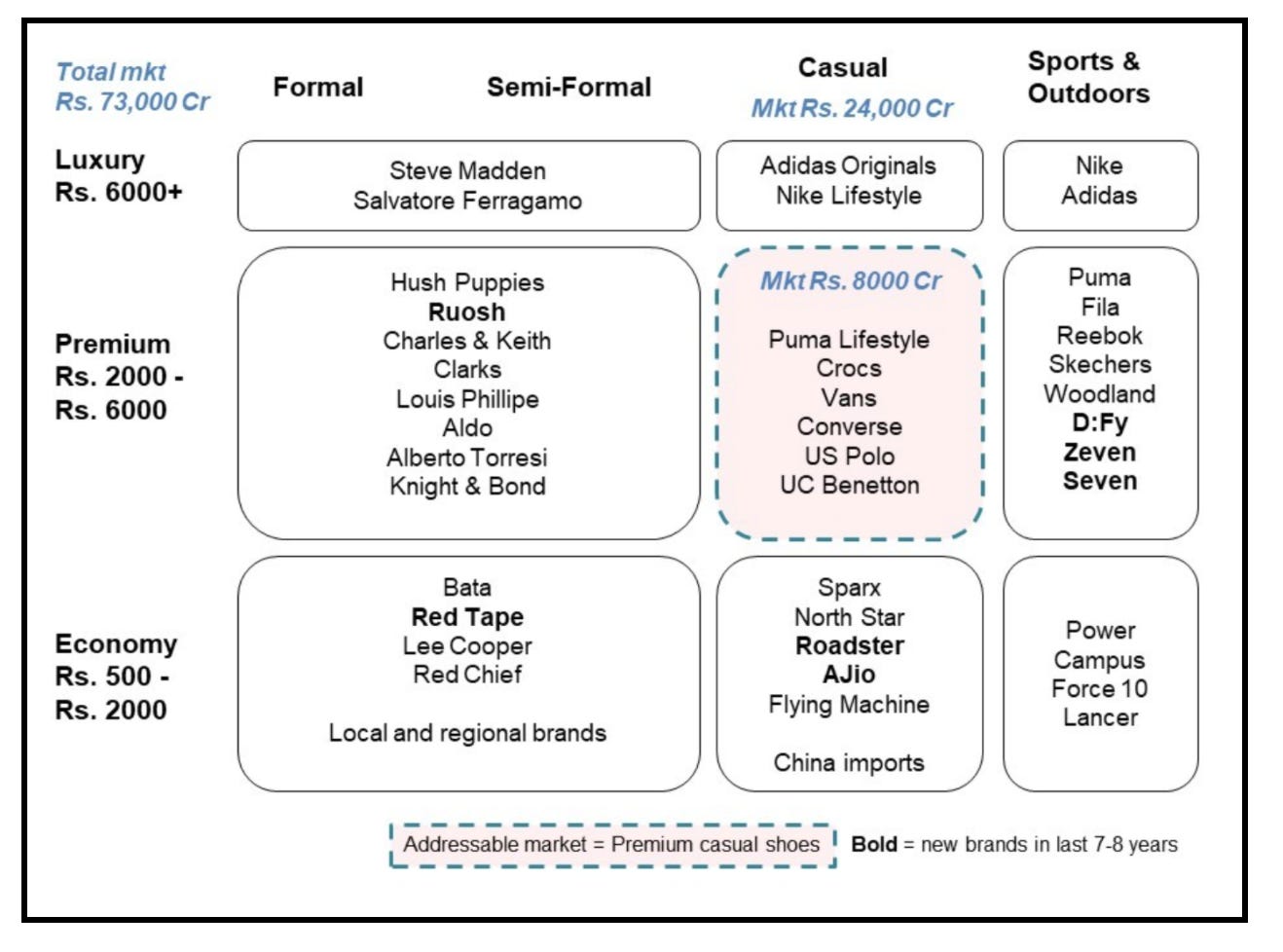

The Indian footwear market is Rs. 73,000 crores ($10 Billion+) in size and growing at 15% annually. The premium casual footwear segment [priced between Rs. 2000 to Rs. 6000] is estimated to be Rs. 8,000 crore ($1.2 Billion).

Ganesh sees a clear opportunity to build an Rs. 700 crore ($100 Million) brand in the next 7–8 years in the premium casual shoes segment.

How do you go about building a D2C Shoe Brand?

With the above core insight in mind, the two started figuring out how to develop a prototype that can build a lightweight, breathable & cushioning shoe.

Utkarsh & Ganesh are both Mechanical engineers. They have worked on product development on the shop floor and understand how product specs translate to products. It took them nearly four months of consumer research to understand the use case of the shoes they’re going to build. They also went to factories in China [also attended a Canton fair— one of the world’s largest consumer products trade show], met Chinese suppliers to understand how shoes are made.

During this time, they also taught entrepreneurship at NID, where they met Suthirta [now a lead designer at Flatheads], who was running the Indian Centre for Natural Fibres. With him, they started tinkering around with knit fabrics, a technology first introduced by Nike at a price point of nearly Rs 20,000.

Flathead Shoe Breakdown - How are they different?

To understand how Flatheads shoes are different, you have to first understand the anatomy of a sneaker.

Flathead uppers are made from knit fabric— that is ultralight, breathable, easy to manufacture, and fits around the “last” as a single piece.

This upper is then stuck to the sole to create a basic prototype of a shoe. The insoles and soles are lightweight, flexible, and offer best-in-class shock resistance.

Knitted Natural fibers are inherently breathable and soft on the skin. The only problem - scuff resistance is very low, meaning they’re not very durable. So they started experimenting with blends to ensure durability and to introduce a moisture-wicking property as well.

Product

In October 2019, they launched 3 product lines— Ooof, Vronk & Kapow.

Another challenge that came up was, India doesn’t have standardized foot sizing despite being the second largest consumer & producer of footwear. You usually have a UK size/US size but no India size.

So for the first product lines, the Flatheads team came up with an A/B testing method borrowed from the tech world. To A/B test the sizes & the fit, Kapow was made a tight fit, Ooof was medium fit & Vronk was a relaxed fit. And then, the return rates gave an estimate of which fit works.

In November 2020, they launched Aurea - shoes made from Bamboo.

Journey of a shoe

The key clusters for manufacturing are Ludhiana/Jalandhar. Leather shoes are mainly sourced from Agra, Kanpur, Chennai. However, most knit manufacturers are located in Coimbatore & Tirupur since it is a hub for fashion apparel manufacturing.

Ganesh & the team were able to source a few materials from Tirupur, from manufacturers who primarily made clothes but also had the capability to manufacture knit shoes.

To keep costs low, the team decided to keep the basic three layers only - Upper, Sole & Insole with monochromatic designs.

Once these three basic layers are completed, then you look out for accessories - lace, tape, labeling, sizing, etc., around the supplier’s area.

Once a prototype is built, you need to do 37 different tests for crucial properties such as durability, size, fit, etc. The quality parameters are benchmarked with world-class specifications from brands such as Clark, Skechers, etc.

Even in packaging, a standard shoebox typically weighs 1.5-2 Kg volumetric weight [including the box]. You need some innovation to get to a <1 Kg box leading to lower pricing for e-commerce logistics. It also has to be sturdy enough so that a stack of boxes doesn’t collapse during transportation.

Once the prototype is approved, production begins with negotiations on the number of shoes and unit costing. After a final quality inspection of the production lot, the finished shoes are sent to warehouses in Delhi & Bangalore.

Unit Economics

Manufacturing cost is roughly 33% of MRP. More prominent brands usually have a lower COGS %age [15-20%], and the difference goes into extensive branding activities.

For Flatheads, manufacturing was comparatively cheaper as well. Knit fiber uppers are easy to manufacture, so that Flatheads can create lower units per style [about 300-400 units per style compared to 2500 MOQ for leather]. At the startup’s early stages, one would rather have a higher cost per unit than being left with unsold inventory.

Knitting is an entirely automated process where one machine churns out one pair of shoe uppers every 2-3 hours. On the other hand, Leather requires stitching together different parts, which is manually intensive and requires more time & money.

Apart from manufacturing, the logistics costs are about 15%. Ads & Marketing costs were as high as the price of the shoe, to begin with. But as the brand keeps getting stronger, the costs go down. Currently, Flatheads has a RoAS of 2 to 2.5.

CM1 = Contribution Margin 1. Read more about contribution margins here.

GTM strategy

Ganesh & co. initially started pitching to their family & friends and got their first 100-150 orders through that channel. To start off, they ran a pre-order email campaign. It was a simple sign-up page to collect email ids. Then they posted on Linkedin & Facebook and boosted the posts to create a sense of intrigue & got around 3500 email signups, of which 200 ordered eventually.

Flatheads mainly uses Instagram & Facebook for ad-based targeting with a focus on the urban working-class.

Views on influencer marketing

Influencer Marketing is great for personal care brands or FMCG brands because you need to send a lot of samples to the influencers. And the cost of sampling is very low in such businesses. If the influencers like it, they will promote it on IG, boosting traffic & conversions to your website. Mamaearth, Sugar Cosmetics, Bombay Shaving Company, etc., have exploited this channel very well.

For Flatheads, the cost of sampling is relatively high. Ganesh says

If I select 50 pieces for sampling, package it & send it to 50 influencers, account for returns, and everything, the logistics cost significantly increases. Plus, I hardly make 300-400 pieces per style. If I send 50 for sampling, what will I sell? I’m not saying it absolutely doesn’t work. We just haven’t found the right way to do it so far for our needs.

More than sampling-based influencer marketing, Flatheads is looking for something more genuine— brand evangelists [or ambassadors] who’ve probably used their product, love them, and are genuinely willing to spread the word.

For example, Ganesh recently learned that folks like Pankaj Advani, the billiards player, Siddharth, the South Indian actor, and Abhinav Mukund, the cricketer, like Flatheads’ shoes very much. One entrepreneur from Chennai liked their shoes so much he publicized them in his Chennai network, and they got a massive spike in orders from there. Channels like these are where Flatheads wants to start their brand identity building.

Current Metrics

Flatheads is trying to become net marketing +ve going forward [the marketing costs, direct costs, & COGS should be covered].

Becoming EBITDA +ve is the next goal.

Funding

Flatheads has raised about 5 crore INR through angels. Their fundraising process was unconventional as well. Ganesh says

We created a video of us talking about Flatheads— what Flatheads is, what is the concept, and why we are the right guys to do this & put it up on LinkedIn. In 72 hours, it went viral. About 400-450 people pinged us saying they wanted to invest. Eventually, 40 people became angel investors in Flatheads.

Vision behind Flatheads

“You spend hours researching before buying a sports shoe. And you wear that 7 hours a week. Why don’t you do the same with casual shoes when you wear them 50-60 hours a week?”

The core hypothesis behind Flatheads is to introduce casual footwear that can be worn all day, every day. Its early customers would say, “It feels like wearing socks.” That is the kind of feedback Flatheads is chasing, with “share of shoe closet” as the north star metric.

“USPA, Flying Machine, Roadster, HRX, etc., will give you shoes that look great, but they are very massy shoes, with no comfort either. We want to bring in an aspirational element at a slightly premium segment of Rs 2000-5000”

And there is enormous depth in this category if it is viewed from a use-cases perspective. For the WFH audience, Flatheads have recently launched a new slip-on lounger called Troos made out of bamboo, blended with natural fibers.

Bamboo is lightweight, breathable, and has active moisture-wicking and anti-microbial properties. It also helps keep the insides cool, making it perfect for the Indian tropical climate. So innovation with new fibers & new designs in this space is something Flatheads will continue to push on.

Athleisure or performance requires a different level of R&D, and Nike is an undisputed leader there. It is challenging to beat standards there and offer at a great price point at the same time.

Why could it fail?

Aspirational D2C brands thrive on discretionary spending. Flatheads can fail if one day everyone decides that comfortable shoes are not a necessity; this is Ganesh's worst nightmare. That nightmare came true when Covid-19 hit.

“If we could’ve failed, we would’ve failed already when Covid hit us. But the grit and perseverance shown by the team during those days were phenomenal to watch. It gives you immense motivation to keep going.”

How did you tackle Covid?

COVID was a stress test. When online shopping picked up, it was a classic David vs. Goliath moment for smaller brands like us. Every big brand had shut down marketing campaigns - Myntra, Amazon, etc. But we told ourselves, we’re going to push the gas pedal when no one is. We launched marketing campaigns, and June was our best month ever— RoAS was through the roof.

On expansion into other business line post-Covid

At Bain, there was a term called “Profit from the Core.” It means you first focus on core business. Until you can extract the full potential from the core, you should not expand further. Creating complexity early only creates more problems.

Brand perception plays a vital role in the D2C space. It governs your pricing, your shelf space, your marketing campaigns, etc. That is sacrosanct. With Covid, despite a month of brainstorming, the team couldn’t figure out a reasonable space to expand, so they dropped the idea.

And Ganesh mentions this as a key lesson for all D2C entrepreneurs. Have a solid belief in brand perception and think deeply about second-order effects whenever it is at risk.

D2C - The future of retail?

With domestic manufacturers willing to experiment with small brands, logistics more or less sorted, and growing online consumption, the stars are aligned for the D2C space. As per Avendus Capital’s D2C report, India’s D2C sector is estimated to become a USD 100 Bn addressable market by 2025.

Concerns around D2C brands remain, though. High CACs [customer acquisition costs] & borrowed supply chains lead to lower margins and unhealthy unit economics. Brands must plan to vertically integrate [by, for instance, creating their own manufacturing operations instead of contracting it out] in order to preserve margins.

As D2C distribution becomes a bottleneck to growth, D2C brands will have to dip their toes in physical retail [omnichannel strategy] but remain careful to maintain the “online-first, retail-second” mindset, which allows them to continue reaping the D2C success benefits.

There’s very little evidence that Amazon, Facebook, and Google’s dominance over e-commerce isn’t going to slow down in the future. But there’s also a ton of evidence that it is more than possible to build new, powerful retail brands today.

From Lenskart to Mamaearth, the playing field is as open as ever for entrepreneurs with ideas for products that people actually want to use. The growth trajectory will be determined by the speed of the team and the money available to spend on brand building. And the best part — there is space for multiple brands to co-exist in the same category. It is not a winner-take-all game like the tech startup stories.

The playbook may be ever-changing, but the route to success has become a little more direct. 😉

Next up in this series, we will post an article on “8 tips on building a D2C brand | by Ganesh Balakrishnan | Co-Founder of Flatheads”.

If you liked this article and would love to read our next one, please subscribe to the newsletter or follow us on Medium. [Yes, we are on Medium too!]

D2C will succeed as long as the home work is Detail2Concept and the Final Product is Delight2Consumer!