InsurTech: How Rahul Mathur's BimaPe is simplifying insurance

This 4 month-old startup has set its sight to help you make better decisions about insurance.

Did you know that even your Paytm Payments Bank card gives you an accidental insurance cover of 2 lakhs?

Did you know you can get upto 1.5 lakhs of insurance cover in case of a plane hijack on HDFC Millenia cards? 🤯

Shocked? We were too! Check out BimaPe, and you may discover more than 2 crores of free insurance cover with your cards!

Insurance. The opaque industry & complex products that everyone wishes they understood, but still remains confusing for the general public.

4 month old BimaPe hopes to change that. “Our current MVP - Know Your Card lets you discover the hidden insurance benefits of your card (debit/credit)”, says its cofounder and CEO Rahul Mathur. The insurance discovery tools along with educational material (Awareness by BimaPe) has driven 3,000+ sign-ups in < 2 months & users have discovered 10,000 cr+ of insurance benefits through BimaPe as of now.

Rahul with his massive following on Substack, Medium & Twitter leveraged it to acquire the first set of users, build products in public, obtain feedback and iterate. In an industry with high CAC, BimaPe proudly functions with zero cost of acquisition.

In a candid interview with Startups Unplugged, Rahul gave us a riveting inside look into BimaPe’s growth and future plans.

The Story

BimaPe started out with the sole objective to simplify the complex web of opaque insurance policies in India. And in only 2 months of coming out of stealth mode, it’s MVP Know Your Card has crossed 3000 signups with more than 30-40 signups coming daily.

How did BimaPe reach here?

For Rahul Mathur, Founder of BimaPe, the tryst with insurance began on a personal note. As a young 12 year old he saw his mother's hospital bills climb to over 40 lakhs. The insurance sum, with a 25k monthly premium couldn't cover the whole amount. Fast forward to 8 years later, he found a neat developed insurance sector in the UK while studying at University of Warwick. The InsurTech sandbox piqued his curiosity and he started writing about InsurTech through a SubStack newsletter called InsurTech Tribe in 2018 that quickly reached the top spot in InsurTech newsletters on SubStack.

Soon he started working as Product Manager at Laka Insurance and then at Accenture. But a sense of purpose was missing. Quoting from his Medium article,

My ‘purpose’ for being in the UK was primarily to signal to others — “I didn’t waste my foreign education; look — I found employment here.” However, I’ve increasingly begun to realise that living in fear of what others *may* think is no living at all…

I like to believe that my true purpose is to be a good son, good grandson and good citizen. As I look to my ageing grandparents, I wish to stand by them in their final steps as they stood in my first steps. As I look to India’s evolving digital public infrastructure, I feel the urge to build for India and contribute to India’s consent architecture.

And Covid-19 provided just the drive for him to move back to India. He dove deep into National Health Stack and researched countless hours over nearly 6 months. He found certain key insights around insurance.

Insurance’s broken back

Humans take a lot of risk during any normal day. Any desire to hedge a risk gives rise to a potential insurance product and your probability to judge that risk & reward defines your willingness to pay for that insurance. This is all a very subjective concept, and hence in a broken society system like India, becomes too complicated too quickly.

Rahul believes there is a fundamental trust gap in the insurance industry. At its core, insurance is a promise to pay in an unforeseen circumstance. And there are 3 critical “moments of truth” that define a trust relationship between an insurer & an insuree:

Helping the insured select the right plan and avoid irrelevant ones. This helps them avoid paying unnecessary premiums, and situations where a patient (after having paid premiums regularly for five years) is denied reimbursement citing non-applicability of the plan.

Helping the insured with timely information about doctors, hospitals, diagnostics and treatments that are covered by the existing plans. This helps a patient plan expenses appropriately, and sets the right expectations about what can be reimbursed by the insurer.

Helping the insured with claim processing and payouts. This is the most significant moment of truth. Successful and brisk claim processing amplifies trust, and unsuccessful, cumbersome and slow processing weakens it.

Source: YourStory

People don’t really need a lot of insurance products. But the variety of products available, from life insurance to cyber insurance, in the absence of a good mechanism to figure out who needs what kind of product, leads to chaos and trust deficit. The big-ticket insurances - the kind where you’re likely to end up in the hospital - are riddled with complex terms & conditions. In such a situation, you are likely to be stressed at a time when you need help the most. And trust factor becomes all the more important.

On top of an already complicated product, it is made more complicated by a salesman you can not trust. Selling insurance today is more about fooling the customer than informing and empowering him/her to make the right choice. Rahul founded BimaPe along with long time friends - Vishrut & Eashan and acquaintances - Abraz & Kunal, to enable informative and value based insurance selling and ensure frictionless experience to customers.

Insurance Portability

Another area of concern is lack of standardised products that consequently make it difficult to compare insurance products across similar parameters. This also leads to hurdles in insurance portability. Consider how health insurance portability currently works:

When you want to port your health insurance policy, you need to approach the new health insurer at least 45-60 days before the expiry of your existing health insurance policy. Once you are there, you need to fill a proposal form for portability, details of previous year policy copies and then apply for portability. On receipt of the request, the new health insurer will approach the existing insurer to know your medical and claims history. Understanding the situation, the new health insurer can accept or reject the proposals based on the information received and the underwriting guidelines.

Once the new health insurer obtains all the details, they have to take a decision on whether or not to accept porting of the policy within 15 days. If the insurer fails to do so, they will have to compulsorily accept the application.

Source: Economic Times

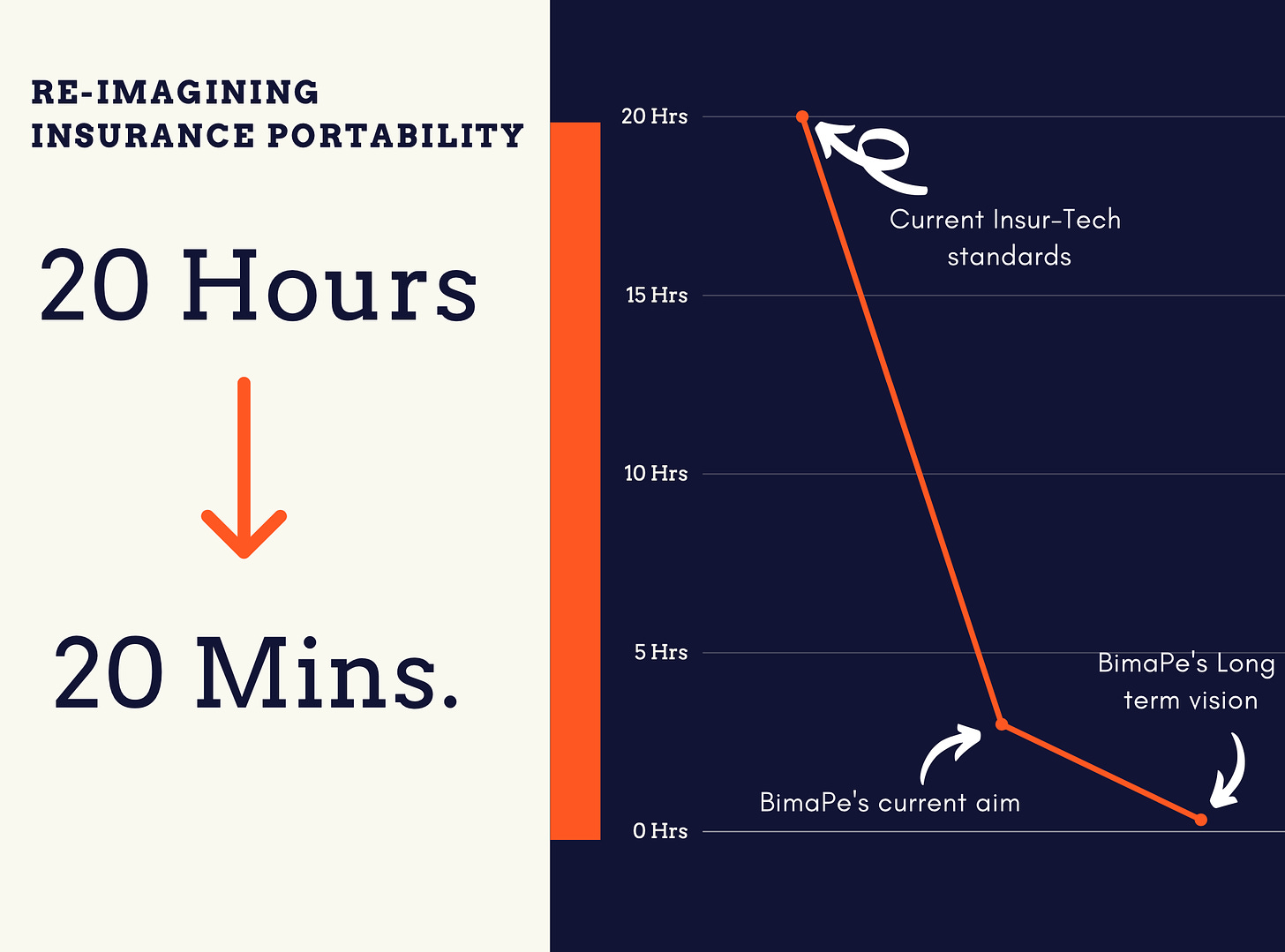

With more standardisation and improvement in National Health Stack, BimaPe aims to cut 20 hours worth of effort of portability down to 20 minutes.

Riding the Insurance Wave

Covid-19 has seen a record jump in retail investors and people becoming more aware about their finances. The number of demat accounts opened this year has increased nearly 25% YoY. The insurance penetration in the country is hardly 5% with agents as the main distribution channel ( 42% ).

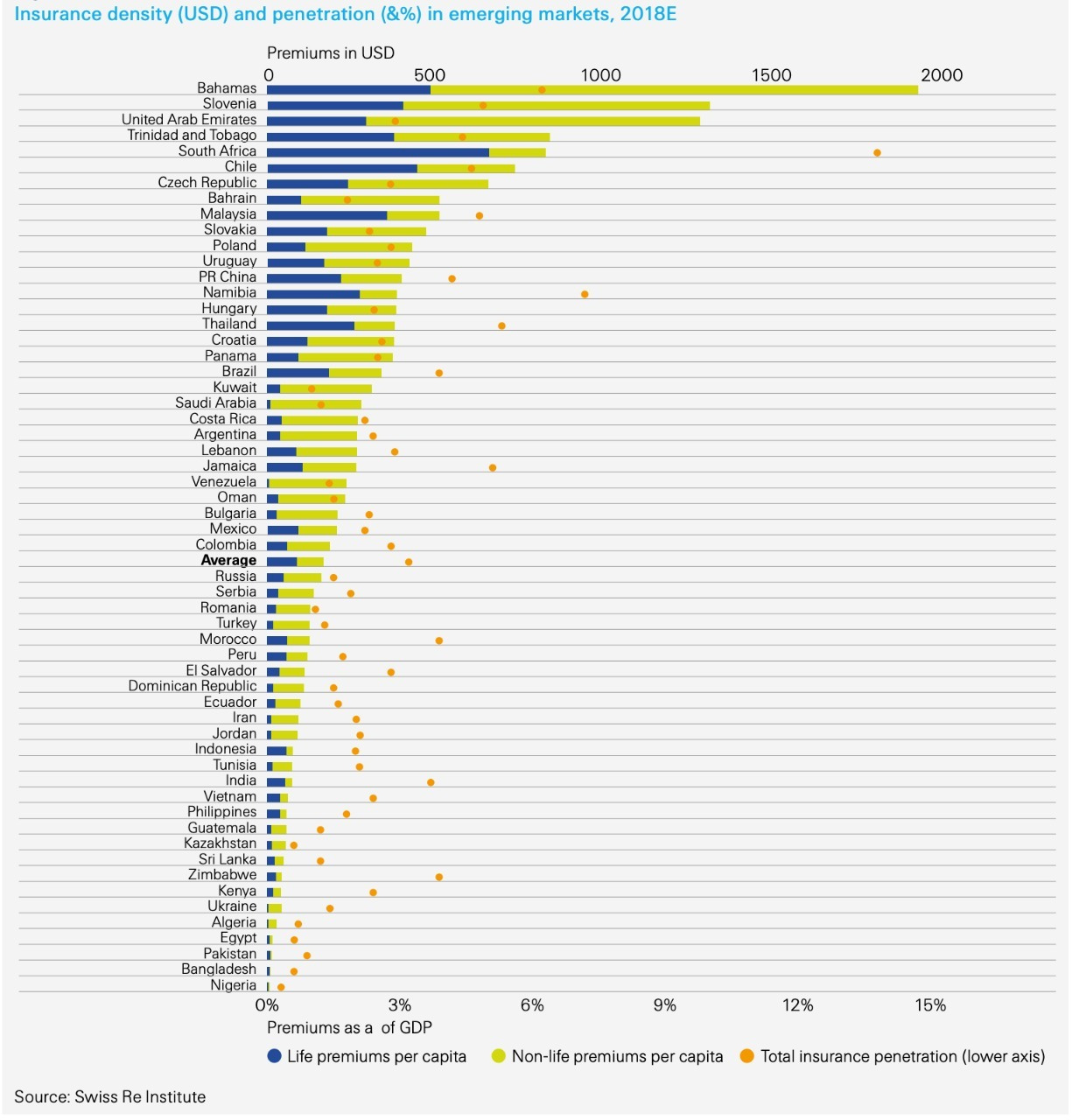

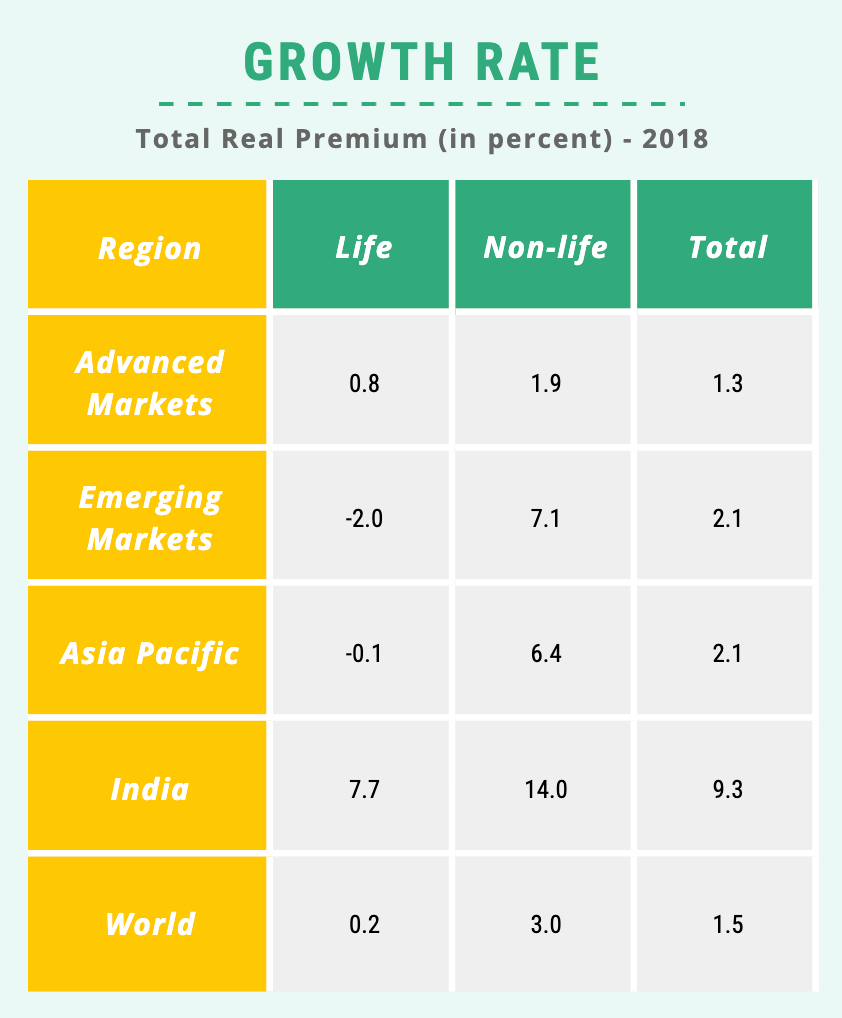

Couple that with a $100B premiums market growing at 9.3% YoY (as of 2018, with world average at 1.5% ) and IRDAI setting up insurance standards in 2019, and you have a strong growing market ripe for disruption. The emergence of National Health Stack only gives further impetus to a promising period ahead for HealthTech players.

Although there are other players like Acko & PolicyBaazaar, what separates BimaPe is it doesn’t have its own insurance product, removing possibilities of a conflict of interest. Traditional players focus largely on figuring out what’s best for you and asking you to buy it. BimaPe’s focus is on building a seamless user-experience end-to-end from managing & buying insurance to claiming it.

Distribution is where insurance is broken. As long as there’s a platform educating customers, transparent with its insurance recommendation and tactical about partnership decisions, it will generate a flywheel of trust from both ends. Making insurance as easy as selling software, is a benchmark that BimaPe is trying to achieve in the next 6 months. And this is where BimaPe’s product roadmap comes in.

Yes, it’s a product issue!

Know your Card

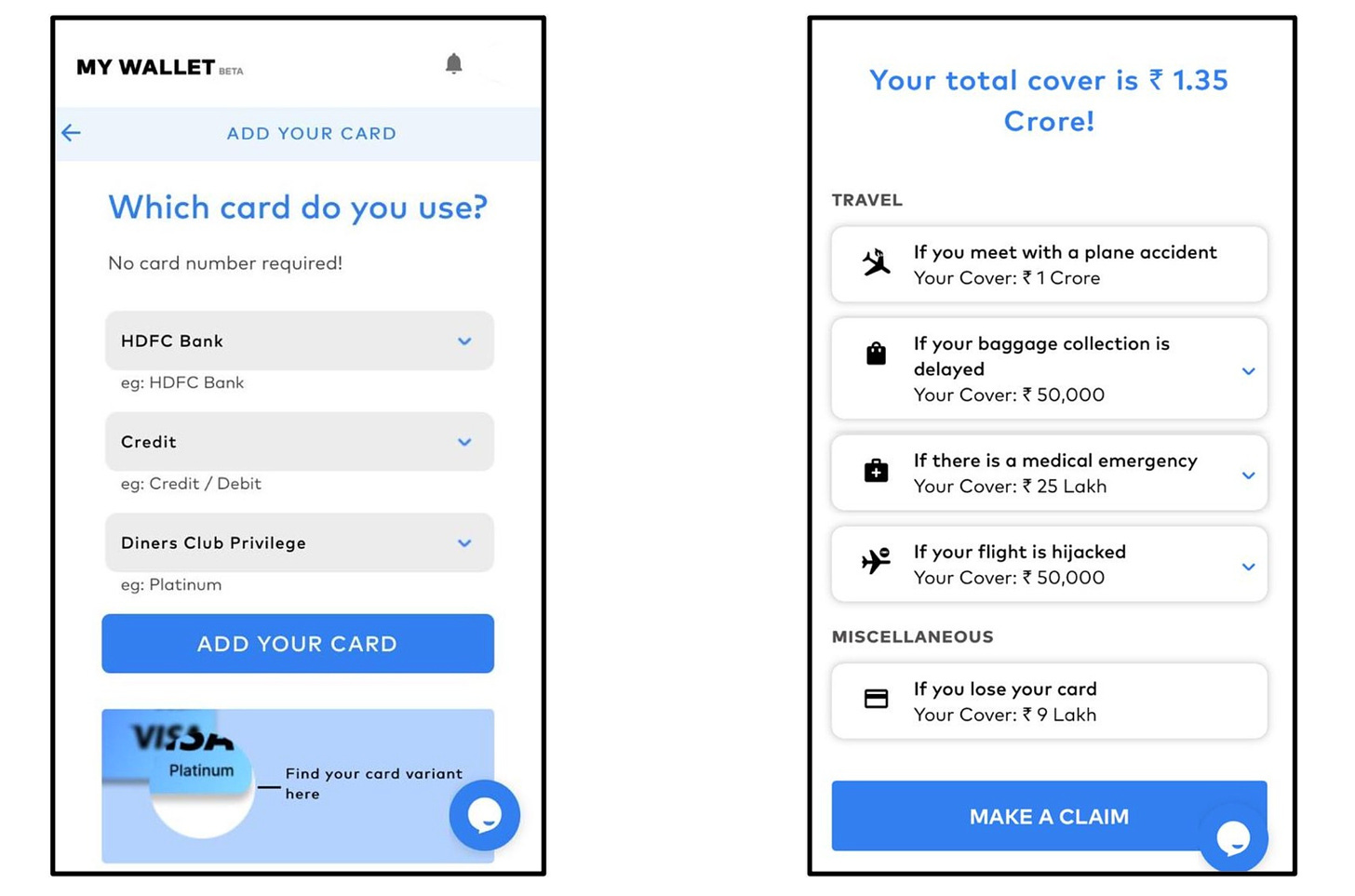

The Know Your Card is a simple yet effective tool that tells you the hidden benefits of your card (debit/ credit). All it requires is for you to enter your bank, type of card & card variant.

“In my opinion, no one is advising them not to buy travel insurance because their cards already cover it,” said Mathur.

The free insurance checker tool, built on the India Stack analyses the fine print around insurance buried inside various T&Cs associated with a particular card and throws up the benefits in a consumable format. It has already seen over 3000 signups in less than 2 months. BimaPe is building integrations powered by the India Stack such as Account Aggregator for future releases.

Policy Deconstruction Algorithm (PDA)

Next product is a Policy Deconstruction Algorithm (PDA) which will essentially be a Text Analytics Script that will scan through long complicated policy documents and output the key terms and conditions in a user friendly format. It can then be used to recommend insurance policies to users, analyses their current plans & quote real-time prices. Users will also be able to select detailed parameters on the platform which will then match it with an insurance product. Once insurance parameters are standardised, such a tool will be incredibly powerful and the data collected through this process will further improve the model over time.

Distribution

On the distribution side, BimaPe will continue to focus on D2C and later evolve into a mix of D2C & B2B SaaS product. Brokerage & licensing fee would remain as key monetisation lever, and also a big challenge going forward, however, Rahul is quick to emphasise monetisation is not the current focus, awareness around insurance & gaining trust is.

The Moat: Building in Public

Another moat with Rahul is his massive following on Substack, Medium & Twitter. He’s leveraged this following to acquire the first set of users, build products in public, obtain feedback and iterate. He credits his Substack newsletter to help him stay close to his customers, while LinkedIn has helped him connect with business leaders in insurance who’ve read & appreciated his content. BimaPe has also used WhatsApp as a channel to build a community of nearly 1600+ members who regularly receive insurance snapshots daily. This community also serves as a strong channel for testing out new products. In an industry with high CAC, BimaPe proudly functions with zero cost of acquisition, so far.

Funding

As per Rahul, BimaPe has secured a small undisclosed funding amount from a prominent VC to generate enough runway for a few months. Currently, all focus is on strengthening the core product offering through the funding.

In other news, BimaPe is hiring. 🥳

Great Article! ✌️

Love this!